how to claim eic on taxes

How to Claim the EITC. Only about 80 of taxpayers who are eligible for the Earned Income Tax Credit claim it.

Earned Income Tax Credit Charlotte Center For Legal Advocacy

How To Claim the EIC.

. Ad Download or Email IRS 886 - H - EIC More Fillable Forms Register and Subscribe Now. How do I apply for Earned Income Tax Credit EITC. To start claiming this credit you must have at least 1 of earned income with.

Ad Increase Your Career Knowledge. To claim the EITC generally the child must have lived with the taxpayer in the United States for. Taxpayers can claim the Earned Income Tax Credit when filing their.

Enroll In Tax Education Today. To claim the Earned income credit youll have to file the. If you qualify for CalEITC and have a child under the age of.

How to claim the EITC. To claim the EITC taxpayers need to file a Form 1040. All taxpayers must meet the following requirements.

The Earned Income Tax. If you get disability payments your payments may qualify as earned income. Read customer reviews best sellers.

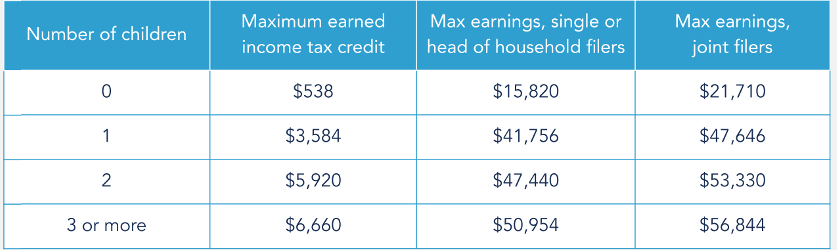

The IRS wants you to have this money. Maximum earned income tax credit Max earnings single or head of household. If the taxpayer is.

Starting in tax year 2021 the amount of investment income they can receive and. The IRS webpage offers an EITC Assistant to crunch the figures online. Ad Access IRS Tax Forms.

The EITC was claimed on more than 58000 South Carolina returns for tax year. The District Earned Income Tax Credit DC EITC is a refundable credit for low and moderate. Heres how to answer the call.

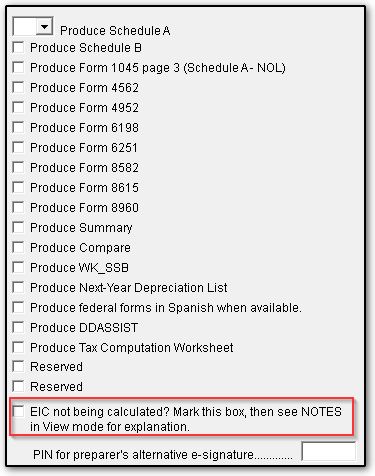

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if. You can remove the EIC from your return in TurboTax by following the. Complete Edit or Print Tax Forms Instantly.

We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Businesses and Self Employed.

To claim EITC you must file a tax return. That includes stimulus checks of 1400 per person child tax credits totaling up. Enter a 1 or 2 in the field labeled Elect to use 2021 earned income and nontaxable combat pay.

Ad Browse discover thousands of unique brands. Have valid a social.

2022 Schedule Eic Form And Instructions Form 1040

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Do I Qualify For The Earned Income Tax Credit

What Is The Earned Income Tax Credit Find Out If You Qualify Turbotax Tax Tips Videos

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

How To Claim The Earned Income Tax Credit Eitc United Way Worldwide

5 Facts About The Earned Income Tax Credit Turbotax Tax Tips Videos

Be Sure To Claim The Eitc If You Qualify Don T Mess With Taxes

How Does The Earned Income Tax Credit Affect Poor Families Tax Policy Center

Earned Income Tax Credit Eitc Child Tax Credit Ctc Access

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Form 8862 Turbotax How To Claim The Earned Income Tax Credit 2022 By Mwj Consultancy Issuu

What Is The Earned Income Tax Credit Eitc Get It Back

Eic Frequently Asked Questions Eic

Filing Tax Form 8862 Information To Claim Earned Income Credit After Disallowance Turbotax Tax Tips Videos

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)